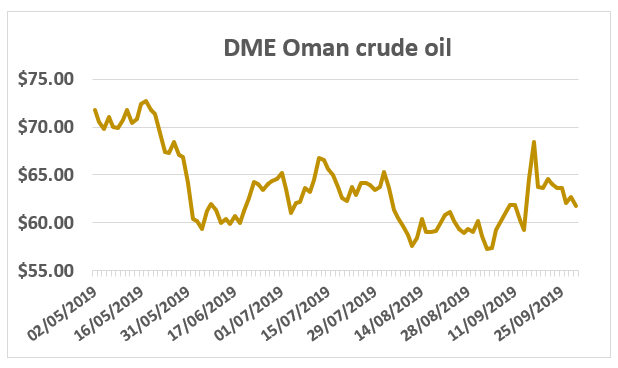

The September 14 attacks on Saudi Arabian key oil processing facilities sent shockwaves through global oil pricing in what was one of the most volatile periods ever recorded, as markets reacted to the single largest disruption event ever with 5.7 million barrels of crude per day -- or over 5% of the world’s supply -- taken out of circulation.

The international Brent benchmark initially spiked almost 20% to hit a high of more than $70/barrel on front-month November futures as traders reacted to the news as Exchanges reopened the Monday after the weekend attacks, rallying to almost $72/barrel and registering the biggest one-day jump on record.

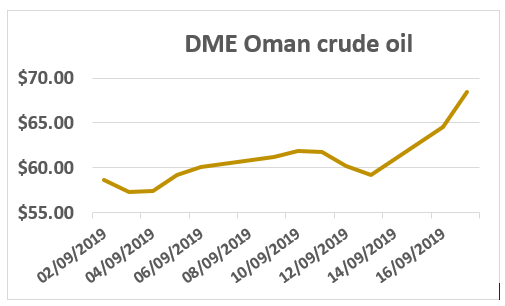

Prices calmed later in the session as Middle East markets opened and the regional DME Oman benchmark rallied more than $5/b to around $64.50/b for November delivery, or 9%, and gained a further $4/b the following day to hit a four-month high of $68.44/b. Overall the two-day price surge added 15% to the value of Oman crude oil. The price of Oman is closely tracked across the Middle East and Asia as both producers and refiners use the price in term contracts.

As the world’s largest exporter, Saudi ships out around 7 million b/d of crude oil so the sharp price spike came as little surprise. The Kingdom, as OPEC kingpin, has essentially served the global oil markets as supplier of last resort for many years which further exacerbated market concerns of a major supply constraint. The installations that were targeted are complex units that separate oil, gas and water and remove any impurities from crude, so without a functioning system the production side can be severely hampered.

But as the Saudi government and oil officials quickly moved to reassure the markets that disruption to customers would not be anywhere near the severity that many had feared oil prices quickly went into retreat and Oman dropped by around $5/b on September 18.

By contract expiry (September 30) November DME stood at $61.73/b – an increase of $3.12/b since the first trading day of the month, and up around $2.50/b from pre-attack levels.

Swift response

Within a week of the unprecedented strikes Reuters reported that Saudi Arabia had restored more than 75% of crude output lost after attacks, wiping out around half of the price gains seen in the immediate wake of the attacks. Saudi Arabia was able to keep customers supplied with prompt requirements from vast inventories both inside and outside the Kingdom, although there was some switching of grades including substituting Arab Heavy for the flagship Arab Light grade

However the attacks have certainly tightened up the physical side of the market, which could be observed in terms of price structure and spreads between the different types of crude oil. While Brent initially outpaced Oman during immediate trading activity following the attacks, the Brent/Oman spread soon narrowed in favor of the Middle East benchmark grade. In quality terms Oman is more closely aligned to Saudi Arabian grades than it is Brent, particularly the Kingdom’s largest grade, Arab Light.

Having settled the Friday prior to the attacks at $0.87/b, Brent’s premium over its Middle East counterpart narrowed to as low as $0.30/b by the following Tuesday and at times has even come close to parity in the latter stages of the month.

Intermonth spreads, which are a measure of market strength, widened during the second half of September reflecting concerns there could be some shortfall on physical availabilities over the next few weeks. The DME Oman November/December spread was already comfortably above $1/b prior to the attack, but widened to over $1.60/b by month end.

Demand for refined products also helped underpin support for crude oil markets due to some disruptions to the Kingdom’s refining system, which in turn boosted refinery profitability across Asia. Increased volumes of gasoil and gasoline were reported heading for the Arabian Gulf to cover the products shortfall. The refinery outages also added to the temporary tightness of high sulfur fuel oil, as stocks are run down already ahead of the IMO 2020 switch which mandates vessels to switch to lower-sulfur bunker fuel. Some also fear there could be shortages of the new 0.5%-sulfur bunker fuel in the Middle East as a result of refinery disruptions.

Summary

The drone attacks of September 14 put the Saudi oil production and supply system under huge stress, but on evidence so far the entire logistical network of the world’s largest exporter has coped remarkably well.

Likewise, markets have weathered the storm with the potential price shock largely kept under control by the swift actions of Saudi Arabia. After the initial shockwave saw Brent prices rally by around 20%, the calmer Middle East reaction saw DME Oman rally by a more measured 9% when trading reopened in the region.

However, the event does highlight the potential vulnerability of oil installations across the Middle East region and for that reason, markets will remain on high alert at least for the meantime.